3rd Quarter 2013

“He who conquers himself is the mightiest warrior.” —Confucius

To our clients and friends:

Let me begin with an anecdote. Upon my arrival on campus as a freshman at the University of Notre Dame several decades ago, I initially opted for a major in chemistry. Shortly thereafter, I realized my mistake and switched to liberal arts—more specifically, psychology. To this day, my roommate (who I am still close to) remains convinced that the reason I switched to psychology was because the psychology building was the closest building to our dorm room! In any event, I am thankful that I majored in psychology.

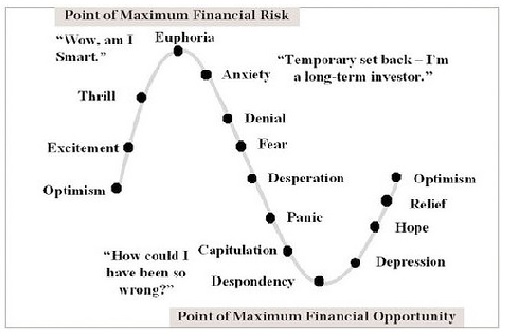

Emotions play a major role in investing. From a psychological point of view, one of the biggest mistakes investors make involves a cognitive bias known as the “recency effect.” This bias rears its head whenever we place exaggerated importance on what has just happened, while downplaying the significance of historical data. It’s a common trait, which is why it’s so important to always subject our hunches to statistical scrutiny.

#4.Diversification across asset classes

We have tried taking a long-term view throughout 2012, despite a great deal of uncertainty. We continue to maintain our belief that at present there is a strong case for stocks over bonds. We also continue to believe that clients will prosper from taking Barton Biggs’ advice to be an owner (equity stakeholder) rather than a lender (bond holder) of financial assets.

Of course, market reversals from current levels are always possible. Those reversals can be sudden and violent. Therefore, when building portfolios, we advocate strong diversification amongst different asset classes. We prefer to focus on lower volatility holdings and shy away from those with higher standard deviations. This focus on reduced volatility and lowered risk has helped savvy investors weather much of the severe ups and downs of the past several years.

#5.Focus on cash flow

The fifth and final principle pertains to the importance of generating cash flow from investments. In this uncertain economic and market environment, we’ve continued to place a premium on the dividend yield generated from our investments. We believe that having a steady cash flow reduces the psychological tensions described by Biggs.

As stated previously this year, it is our view that the returns on investment grade corporate bonds, higher-rated high yield bonds (such as Vanguard’s offering) and dividend-paying equity mutual funds continue to make those investments more attractive than some of the alternatives.

Thank you for reading this newsletter and for your continuing interest.

Sincerely,

Andrew J.Fama, JD, RFC®, MHA, Registered Fiduciary (RF™)

Principal, Fama Fiduciary Wealth LLC

Registered Investment Advisor

*Past performance is no guarantee of future results*

*Nothing contained in this quarterly newsletter should be construed as investment advice*

To download a PDF copy of this Newsletter click here

Disclaimer

This newsletter was produced by Fama Fiduciary Wealth LLC, a New York registered investment advisory services firm. The content is intended for educational and information purposes only and not as investment advice or an offer or recommendation to buy or sell an investment product. Any investment or tax decision made carries risk including the risk of financial loss and is ultimately the responsibility of the individual who should consult beforehand with a financial or tax advisor. Past performance is not indicative of future returns.

About the Author

Andrew J. Fama

Fama Fiduciary Wealth LLC is an SEC-Registered Investment Advisory firm originally established in 2001 under the name of Andrew J. Fama Asset Management. With over 30 years of experience representing financial institutions, businesses and individuals, Mr. Fama understands the risks inherent in all types of investments.

To learn more about Andrew J. Fama click here.