Our Fees

Before you decide if a particular advisor is right for you, ask some basic questions.

First Question: How do you get paid?

You would think that this would be a common question. But many people think it’s impolite to ask how much an advisor charges. But if you’re having your roof replaced, wouldn’t you ask how much it was going to cost? Don’t be shy in asking how the advisor is paid.

There are a variety of ways that advisors are paid. Some are commission-based, such as stockbrokers or insurance agents. Some are fee-based, and charge some commissions but not all their revenue comes from commissions. And then there are fee-only, like some Registered Investment Advisors who are paid directly by the client (you).

We believe that fee-only compensation is the only truly transparent way of being compensated by our clients. Of all the fee arrangements available in the industry, this is the one arrangement that benefits our clients the most.

Asking how the advisor charges will clarify what it is you’re paying for and how much it will cost. If the advisor tries explaining this to you, but you still don’t fully understand, you should ask for something in writing so that the fee structure is crystal clear before engaging their services.

As independent, fee-only advisors, we have taken a solemn oath (the "fiduciary" oath) to act at all times and in all circumstances in good faith and ONLY in our client's best interests. We will not accept commissions, rebates, awards, finder's fees, bonuses or any other form of compensation in exchange for selling our clients an investment product.

Second Question: Will you receive compensation from anyone other than me, as your client?

This question is really a continuation of the first question about how the advisor is paid. But the answer to this second question is actually more enlightening because it will disclose potential conflicts of interest in the advisor’s ability to look out for your best interests and not his or her own.

For example, if a broker or agent received commission income directly from their brokerage house based on the sale of a product to you, then a third party is involved in the relationship between you and the advisor. That third party is the advisor’s employer, to whom the advisor owes a duty of loyalty. Furthermore, if the broker or agent is paid a salary, in the form of a paycheck every other week, then their allegiance is clearly split between you and the employer.

If on the other hand, your advisor receives compensation ONLY from you, the client, and the relationship you have is of a fiduciary nature, then your best interests will be served by the advisor, as opposed to the split loyalty that’s likely to exist between you, the advisor and his or her employer.

Third Question: Who else receives compensation when you handle my investments?

This is a much more complex question and might even require some further thought or research on the part of the advisor.The reason I mention this is that you, as the client, have the right to know who gets paid for you being a client of the advisor.

For example, if you buy a stock, the advisor will be paid a commission, and the brokerage house (the advisor’s employer) will also be paid.

If you invest with an advisor who uses third-party money managers to actually manage your investments (such as a “wrap” program), then the advisor, along with the money manager, both get paid.

If you use mutual funds, and there is a “load’ or transaction fee paid, you should know where that money goes, because you’re the one paying it.

Even if the advisor does not get the fee directly, someone gets it and you should know who that is. Incidentally, “load” funds are the subject of another discussion here on the website, but suffice it to say that they must be avoided at any cost.

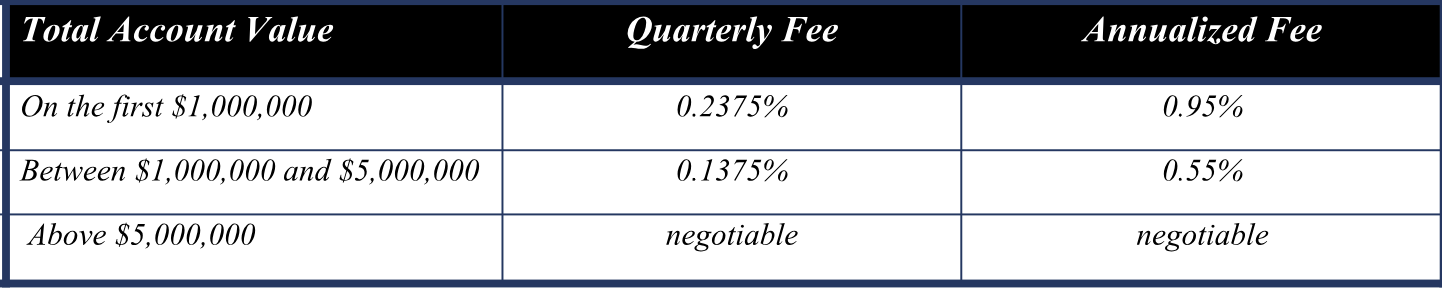

Investment Management Services Annual Fee Schedule

For the provision of comprehensive investment supervisory services, Fama Fiduciary Wealth LLC shall be paid a fee on a quarterly basis in arrears at the basic rate schedule outlined below.

.95 % on the first $1,000,000 of market value*

.55 % on the next $1,000,000 to $5,000,000 of market value

The minimum quarterly fee is $1,500

Fama Fiduciary Wealth LLC shall be compensated on the basis of the portfolio’s market value on the last calendar day of the month immediately preceding the billing period and not upon the basis of a share of capital gains upon or capital appreciation of the portfolio or any portion of the portfolio of the client.

The Custodian of the Account will deduct this fee from the Account and pay Fama Fiduciary Wealth LLC according to the above schedule within 30 days.

Should the Account be cancelled after the end of a billing period but before the end of the next billing period, Fama Fiduciary Wealth LLC shall be entitled to the pro-rata share of the fee based on the number of days within the final billing period for which Fama Fiduciary Wealth LLC rendered services.

Should the Account be cancelled within the first 365 days following the original execution date of this Agreement, Fama Fiduciary Wealth LLC shall be entitled to the minimum annual fee as stated below.

There is a minimum annual fee of $6,000 on all accounts set up under this program.

There may be separate transaction costs charged by the Custodian in order to purchase mutual funds into the account. These are determined based upon the particular fund’s no transaction fee plan.

There is no separate IRA custodian fee. Minimum deposits are based on Fama Fiduciary Wealth LLC minimum requirements, and minimum deposits required by the respective funds.

I understand and accept the above fee structure and authorize the quarterly fee to be debited directly from my account. There is a minimum quarterly fee of $1,500 under this program.